Experts and Analysts agree, vanadium is the miracle metal of new age and Prophecy’s Gibellini vanadium project is leading the charge

Mining stock pick guru, book author who appeared on CNBC, Fox Business News, David Morgan of Morgan Report featured Prophecy Development (TSX: PCY, OTCQX: PRPCF) as his vanadium stock pick in May 2018.

“We are bullish of vanadium due to its various traditional and new age applications in steel rebar, energy storage, and aerospace.

We believe Prophecy’s Gibellini are an exceptional speculation, given project’s location, advanced permitting stage, and leverage to vanadium’s prices.”

Nick Hodge of Nick’s Notebook, a private placement and alert service that has raised tens of millions of dollars of investment capital for resource companies, has this to say about Prophecy Development in his March special alert:

“Vanadium is the next great “electric metal” story. Prophecy is developing what aims to be the first primary vanadium mine in North America.

I have been following this story for some time. The more I’ve learned, the more I realize Prophecy provides great leverage to a vanadium story that’s very real.

We are buying Prophecy Development Corp. (TSX-V: PCY)(OTC: PRPCF) below C$3.00. “

Steve Saville of Speculative Investors in 2018 has this to say about vanadium and Prophecy

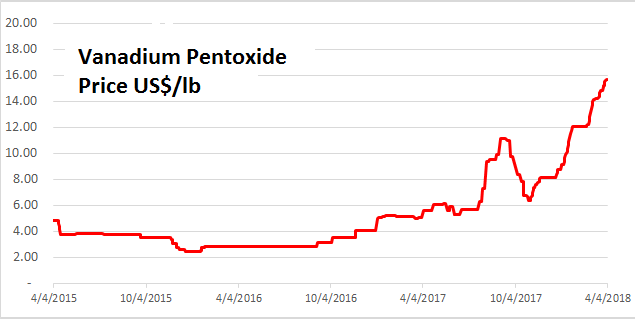

“The following chart shows that vanadium pentoxide (V2O5) entered a long-term bear market that appears to have ended at $2.50/pound in early-2016. The price has since recovered to around $12/pound. The vicious upward price spike in mid-2017 was associated with concerns about declining supply in China, the world’s top producer of the commodity, but the bulk of the long-term upside potential in the vanadium price is linked to the VRB.

PCY.TO Gibellini has about 130M pounds of V2O5 in the M&I category and a 2011 Feasibility Study that suggests economic viability at the current V2O5 price.

With 7.5M shares outstanding, PCY’s current market cap is only C$29M (US$23M). At this time it is an illiquid stock and therefore difficult to trade in size, but it is worthy of inclusion in the Small Stocks Watch List.”

The following January note from Bank of Montreal, a top Canadian investment bank, is as relevant today as it was in January 2018:

“We see significant vanadium price upside due to lower Chinese shipment impacted by more stringent environmental monitoring. Battery demand create further demand pressure”

Ferroalloynet.com, a website that specialise on the trading of speciality metals, noted the following on April 24, 2018

V2O5 flake can hardly be found in spot market. Major suppliers quote V2O5 flake at 190000 rmb/ton ($13.6/lb) but they don’t have inventories at all this month. Jianlong has scheduled full orders for April. Ferrovanadium and vanadium-nitrogen bidding are on the way, attracting much attention of market participants.

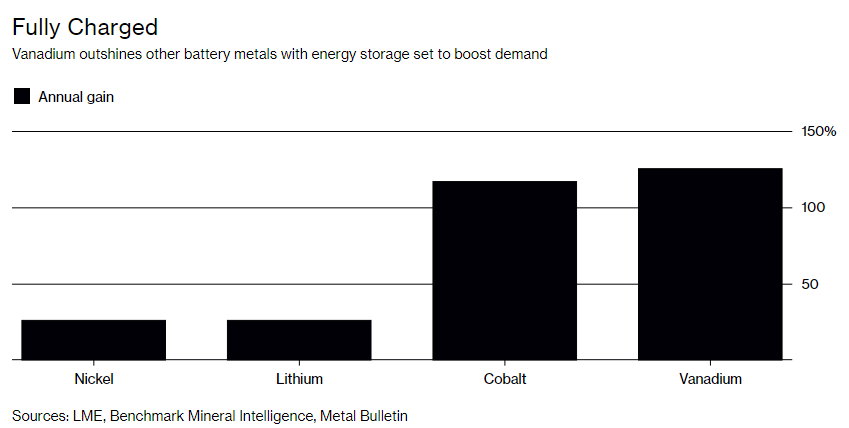

Mark Burton of Bloomberg in early 2018 noted his article Best-Performing Battery Metal of the Past Year Isn’t Cobalt

“Vanadium is rocketing during a buying spree in China

Grid-scale batteries for renewables could drive further gains

“

On December 20, 2017, the U.S. president, Donald Trump, signed the executive order “Recognizing Strategic Importance of Minerals Mining to Domestic Economy, National Security, Infrastructure.” Among other things, he called on U.S. government agencies to identify ways to both

(1) streamline the permitting processes (expediting exploration, production, processing, reprocessing, recycling, and domestic refining of critical minerals) and

(2) ensure that miners and producers have electronic access to the most advanced topographic, geologic, and geophysical data within U.S. territory.

U.S. Geological Survey listed vanadium as one of 23 critical mineral resources of the United States; yet there is not a primary vanadium mine currently in the country.

“Vanadium is used primarily in the production of steel alloys; as a catalyst for the chemical industry; in the making of ceramics, glasses, and pigments; and in vanadium redox-flow batteries (VRBs) for large-scale storage of electricity.

The majority of the vanadium produced in 2012 was from China, Russia, and South Africa.”

Robert Friedland, the billionaire mining legend was quoted by Northern Miner:

“We think there is revolution coming in vanadium flow batteries

You’ll have to get into the mining business and produce ultra-pure vanadium electrolute for those batteries on a massive scale”

Anthony Milewski, Managing Director at Pala Investment Ltd. was quoted by Bloomberg

“I don’t think anyone would dispute that it’s superior to lithium-ion in large-scale grid applications,

Vanadium flow has yet to have its Tesla moment, and therefore it still flies under the radar,”

Click to play Prophecy’s Gibellini (Nevada) vanadium project short clip.

Visit www.prophecydev.com to learn more

Check latest Prophecy price

US Brokers (OTCQX: PRPCF)

www.tdameritrade.com

www.etrade.com

www.fidelity.com

www.merrilledge.com

www.Td.com

www.rbcdirectinvesting.com

www.qtrade.com

www.questrade.com

www.scotiabank.com/itrade

www.bmo.com/investorline